Justice Department backs Mnuchin’s denial of Trump tax returns

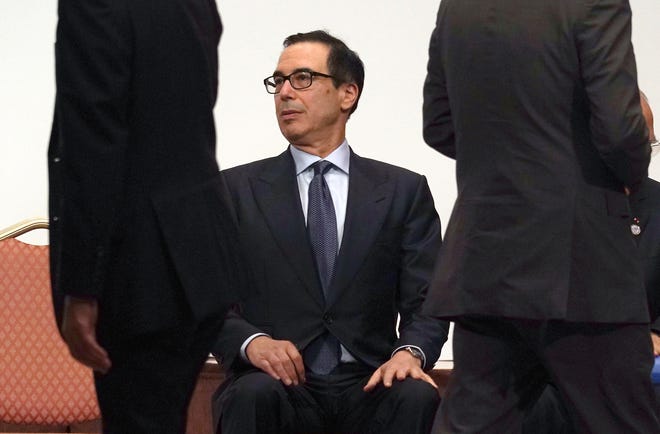

Washington – The Justice Department backed Treasury Secretary Steven Mnuchin’s refusal of House Democrats’ demand for President Donald Trump’s tax information, setting the stage for a widely expected lawsuit that will test the limits of Congress’ powers to investigate the president.

In the 33-page opinion released Friday, Justice Department attorneys said the Treasury Department correctly concluded that House Ways and Means Chairman Richard Neal’s stated reason for the request was “pretextual and that its true aim was to make the president’s tax returns public, which is not a legitimate legislative purpose.”

Neal in April first demanded six years of Trump’s personal and business tax information, citing a provision in the tax code that allows the heads of Congress’ tax-writing committees to gather the returns of any taxpayer. The provision doesn’t say that lawmakers need to state a legislative purpose but many legal scholars believe such a purpose is required. Neal said the committee needed the returns to ensure the Internal Revenue Service was following its stated policy of annually auditing the president’s returns.

Mnuchin put off the request for a month and then formally denied it, citing advice he received from the Justice Department. Neal answered with a subpoena, provoking a similar response from the Treasury Department.

In Friday’s opinion, the Justice Department agreed with Mnuchin that Neal’s stated purpose was not genuine.

“No one could reasonably believe that the committee seeks six years of President Trump’s tax returns because of a newly discovered interest in legislating on the presidential-audit process,” Justice Department Assistant Attorney General Steven Engel said in the opinion.

Spokesmen for Neal did not immediately respond to a request for comment. Neal has said that he expects to take legal action against the administration soon.

A recent law passed in New York State would allow Neal to request Trump’s state tax information, but spokesmen for Neal have said that such information would not satisfy his desire to investigate the IRS’ audit practices.